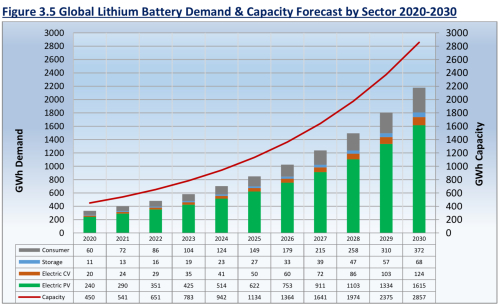

We forecast that while battery demand will rise from 330 GWh in 2020 to 2,180 GWh in 2030, battery production capacity will rise in the same period from 450 GWh to more than 2,857 GWh.

While we forecast global EV sales to grow by a remarkable 21% CAGR over the next decade, the increase in battery production and capacity will be even higher. That is because the kilowatt hour (KWh) battery capacity required per vehicle is likely to rise as well. We estimate the average vehicle battery capacity will increase by 3% per year over the next decade as battery prices fall, allowing OEMs to fit larger capacity batteries to improve driving range. Thus far, fully electric variants have also tended to be of the smaller to mid-size models in an OEMs range, which were easier to electrify to meet emissions targets. But OEMs will increasingly be compelled to electrify most if not all of their fleets. The increase in the e-SUV globally and electric pickup truck segment in North America, for example, will likely increase battery sizes and thus battery demand.

Demand for other home, consumer and energy storage products will also increase the need for gigawatt hour capacity.

Battery production will thus need to increase faster than EV sales volumes would suggest. Furthermore, battery capacity needs to exceed demand significantly because the theoretical maximum capacity of battery plants is rarely achieved as a result of technical and logistical issues. For example, there may be a slowdown due to a shortage of cobalt, cathodes or quality control issues, which could mean that not all cells produced will be viable. A rule of thumb is that a realistic production output is around 70% of the stated maximum capacity.

We forecast that while battery demand will rise from 330 GWh in 2020 to 2,180 GWh in 2030, battery production capacity will rise in the same period from 450 GWh to more than 2,857 GWh.